YouTube’s Ad Empire Rivals Netflix: A Cultural and Economic Shift

The Context

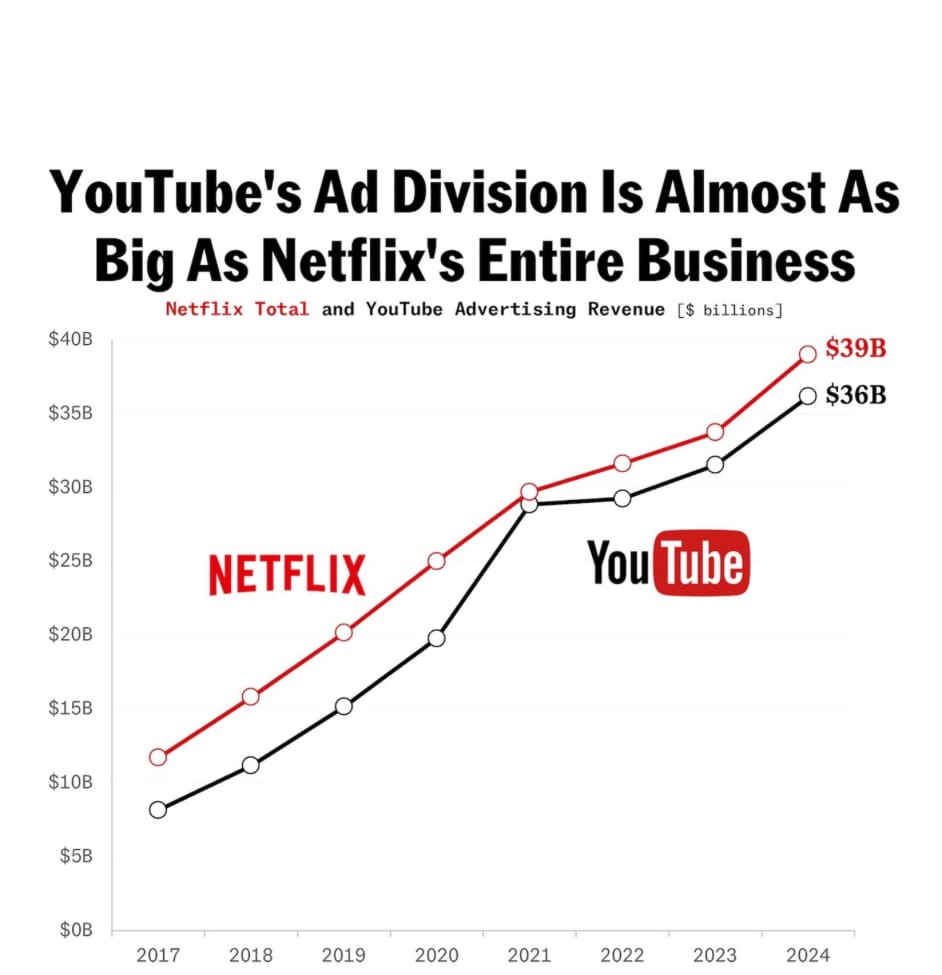

Imagine a digital coliseum where two titans clash: on one side, Netflix, the streaming behemoth that redefined how we devour stories, raking in $39 billion in total revenue by 2024. On the other, YouTube’s ad division, a relentless ad-powered juggernaut, surging to $36 billion in advertising revenue over the same span. This graph, tracing their financial trajectories from 2017 to 2024, reveals a stunning convergence: YouTube’s ad earnings are nearly as vast as Netflix’s entire business. From a modest $10 billion in 2017, Netflix climbed steadily, while YouTube’s ad revenue leapt from $5 billion to challenge the streaming giant’s dominance.

At Truffle Culture, we see this as more than a financial flex; it’s a cultural pivot, reflecting how we consume, create, and connect in 2025. Is YouTube’s ad empire a sign of a new entertainment era, or a warning of a fragmented digital landscape? To understand, we must unpack the data and its deeper currents. What does this rivalry mean for the stories we tell and the screens we watch?

The Roots of a Digital Divide

The graph’s arc tells a tale of two models. Netflix, launched in 1997 and pivoting to streaming in 2007, built its empire on subscription revenue, peaking at $39 billion in 2024, per the data. Its growth—$10 billion in 2017 to $25 billion by 2020, then $35 billion by 2023—mirrors a decade of original content like Stranger Things and Squid Game, drawing 260 million subscribers globally, according to a 2024 Statista report. This model thrives on curated narratives, a Hollywood heir reimagined for the couch.

YouTube, born in 2005 and acquired by Google, took a different path. Its ad revenue, starting at $5 billion in 2017, doubled to $10 billion by 2019, hit $25 billion by 2022, and soared to $36 billion by 2024. This explosive rise, per a 2024 eMarketer analysis, stems from its creator-driven ecosystem—2.5 million active channels and 37 million daily uploads—monetized by Google Ads. The platform’s shift to ad-supported tiers, like YouTube Premium’s $13.99/month option, bolstered this, per a 2023 Variety article. X posts like @AdRevenueKing’s “YouTube’s ad cash is insane” highlight the buzz, while creators credit its accessibility—anyone with a smartphone can compete.

This divide reflects a cultural schism. Netflix’s model caters to passive viewers seeking polished escapism, while YouTube’s ad-driven chaos fuels a participatory culture, where memes, vlogs, and viral hits dominate. A 2024 Pew Research study notes 70% of Gen Z watch YouTube daily, often ad-supported, versus 45% for Netflix, signaling a generational tilt. This mirrors broader trends: the rise of short-form content, with TikTok’s 1 billion users, per a 2024 Sensor Tower report, pressures Netflix’s long-form dominance, while YouTube adapts with 1-minute ads generating $15 billion annually, per eMarketer. The graph’s convergence marks a battle for attention in a fragmented media age.

The Critique: Empowerment or Exploitation?

The data paints YouTube as a titan, its $36 billion ad haul in 2024 nearly matching Netflix’s $39 billion total. This isn’t just economics—it’s a cultural statement. YouTube’s model democratizes fame, with creators like MrBeast earning $54 million in 2023, per Forbes, through ad revenue and brand deals. Its ad ecosystem, per a 2024 Google report, supports 400,000 U.S. jobs, from content creators to ad tech firms. Yet, the graph’s steep rise raises questions: are viewers empowered or ensnared? Ad frequency—up 30% since 2020, per a 2024 Insider Intelligence study—frustrates users, with X’s @NoMoreAds raging “YouTube ads are out of control.” Netflix, meanwhile, faces subscriber fatigue, losing 1 million in Q1 2024, per Statista, as price hikes ($15.49/month) alienate fans.

The critique cuts deeper. YouTube’s ad reliance risks exploiting creators, where 90% earn less than $1,000 annually, per a 2023 Creator Economy Report, while Google pockets the lion’s share. Netflix’s subscription model, though costly, offers ad-free control, appealing to 55% of viewers who prioritize quality over cost, per a 2024 Deloitte survey. YouTube’s chaos—algorithm-driven, ad-interrupted—mirrors brain rot’s digital overload, while Netflix’s curation feels like a curated retreat. Cultural theorist Douglas Rushkoff might argue YouTube’s ad surge reflects a “present shock,” where instant gratification trumps narrative depth. The graph suggests a trade-off: YouTube’s inclusivity versus Netflix’s refinement, with viewers caught in the crossfire.

At Truffle Culture, we see this rivalry as both a triumph and a tension. It’s a triumph for YouTube’s creator economy, giving voice to the marginalized and reshaping entertainment. But it’s a tension when ad saturation and creator inequity threaten its promise, while Netflix’s model risks elitism. The challenge is balancing access with integrity—can platforms evolve without losing their soul?

The Conversation: Who Wins the Screen War?

YouTube’s ad empire, nearly rivaling Netflix’s total haul, is 2025’s digital watershed. The graph’s upward arcs signal a cultural shift: from passive streaming to active, ad-fueled engagement. But it forces us to ask: Does this empower creators and viewers, or exploit them? Will YouTube’s ad dominance redefine storytelling, or fracture it further?

The answer hinges on adaptation. YouTube could refine ad placement—shorter, skippable formats, per a 2024 Google experiment—while Netflix might embrace hybrid models, like its $6.99 ad-tier gaining 8 million users in 2024, per Variety. At Truffle Culture, we see this as a moment to rethink media: a chance to champion diverse voices without drowning them in ads, or to preserve narrative depth amid the noise.

Join the Dialogue

YouTube’s ad rise nearly matches Netflix’s empire—a seismic shift in how we watch. Is it a creative boom or an ad overload? At Truffle Culture, we’re captivated by the data and curious about its impact. What’s your screen of choice, and why? Share in the comments, and let’s explore what this means for our cultural landscape.

References

• The Atlantic, “YouTube’s Ad Division Nears Netflix’s Total Revenue,” 2025 (graph data).

• Statista, “Netflix Subscriber and Revenue Statistics,” 2024.

• eMarketer, “YouTube Advertising Revenue Forecast,” 2024.

• Variety, “YouTube Premium and Ad Strategies,” 2023.

• Pew Research Center, “Gen Z Media Consumption Habits,” 2024.

• Sensor Tower, “TikTok User Statistics,” 2024.

• Forbes, “Top Earners on YouTube,” 2023.

• Google, “YouTube Economic Impact Report,” 2024.

• Insider Intelligence, “Ad Frequency on YouTube,” 2024.

• Deloitte, “Consumer Media Preferences,” 2024.

• Creator Economy Report, “Creator Earnings Analysis,” 2023.