AI is the Catalyst: Cathie Wood Explains How Converging Tech Will Reshape Your World (and Wallet)

Forget market noise. ARK Invest’s chief visionary outlines how converging tech is about to reshape everything .

Forget market noise. ARK Invest’s chief visionary outlines how converging tech is about to reshape everything .

Cathie Wood isn’t just an investor; she’s a tech futurist with a multi-billion dollar portfolio backing her predictions. When she talks, people listen — especially those looking beyond the daily market chaos to spot the next big seismic shifts. In a recent Q&A, the ARK Invest founder laid out her vision for a world rapidly accelerating towards a future powered by converging technologies.

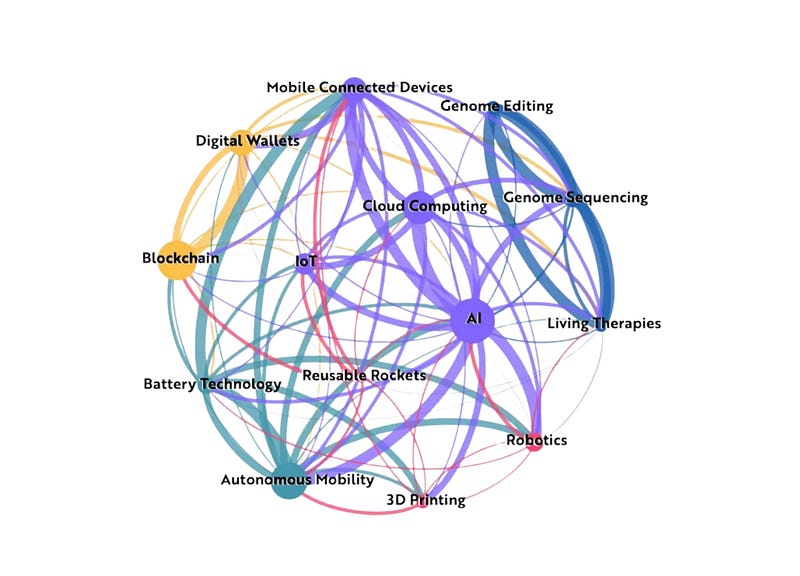

Forget incremental change. Wood argues we’re witnessing a massive convergence of fifteen different technologies, with Artificial Intelligence (AI) acting as the super-catalyst, knitting them all together. This isn’t just about faster computers; it’s about fundamentally rewriting the rules across industries.

Here’s the breakdown of what ARK sees coming and why it matters for your understanding of the future (and potentially, your portfolio):

1. Chaos Creates Opportunity (Even Tariff Turmoil)

Think the current market volatility and geopolitical drama (Trump’s tariffs, policy shifts) are pure chaos? Wood sees it differently. She frames things like tariffs as aggressive “negotiation tactics” aimed at ultimately lowering trade barriers long-term. While acknowledging short-term disruption, ARK anticipates a smoother, growth-oriented path emerging around the 2026 US midterm elections, buoyed by deregulation and private sector innovation. The key takeaway? Tumultuous times often force businesses and consumers to adopt new, more efficient solutions faster — accelerating the very tech ARK bets on.

2. AI Isn’t Just Coming — It’s Revolutionising

AI is the engine driving much of this change. Wood highlighted key areas:

- Robo-Taxis Taking Over: Forget human error. ARK predicts autonomous driving tech (like Tesla’s FSD and Waymo) will be safer than human drivers by late 2025. Combined with deregulation, this could unleash a transport revolution.

- Healthcare’s “Golden Age”: AI is turbocharging drug discovery. Think going from testing 20 hypotheses a year to 200 (like Recursion Therapeutics). This slashes drug development time from ~13 years to 8 and cuts costs dramatically (from $2.4B to $600M). We’re talking faster cures and preventative medicine.

- Superhuman Coders: AI assistants are already boosting software engineer productivity massively — task completion rates jumping from 4% to 72% (nearing 80%) in just a year. This means faster software development and innovation across the board.

Investment Angle: Growth is exploding across the AI stack (infrastructure, platforms, applications), with a shift towards more powerful AI agents potentially disrupting traditional software models.

3. Rise of the Robots (Beyond the Factory Floor)

Robots aren’t just for assembling cars anymore. They’re coming to our homes, shops, and restaurants. ARK sizes the market for humanoid robots and robo-taxis at a staggering $26 trillion globally, split between automating manufacturing and, intriguingly, taking over household chores. This is where Wood’s convergence theme shines: robo-taxis perfectly blend AI, robotics, and advances in energy storage (batteries). The predicted economics are disruptive — costs potentially plummeting from the 4 per mile of current ride-sharing services to a mere 0.25 per This alone could carve our a 10 trillion market within the next five to ten years.

Addressing the inevitable job displacement fears, Wood draws historical parallels, like tractors replacing farm labor. While acknowledging that automation hits lower-value tasks first, she argues it simultaneously creates new, higher-value opportunities. Furthermore, the automation of previously unpaid household labor — cooking, cleaning, errands — represents a massive, untapped economic frontier, potentially unlocking a $250 billion robotics revenue stream just by tackling chores.

4. Powering the Revolution: Is Nuclear Making a Comeback?

Of course, all this computation, automation, and digital transformation demands staggering amounts of energy. So where does ARK see the power coming from? Surprisingly, perhaps, Cathie Wood points towards nuclear energy. Often maligned, she argues it remains the cleanest and safest large-scale power source available. Its progress, however, was kneecapped by overly cautious regulations following the Fukushima incident, which Wood contends artificially inflated energy costs in places like the US. The potential game-changer? Small modular reactors (SMRs), championed by innovators like Oklo (notably backed by OpenAI’s Sam Altman). These compact, potentially more cost-effective reactors could be key to reversing nuclear’s cost trajectory and providing the reliable, clean energy foundation the AI-driven future desperately needs. For ARK, understanding nuclear’s potential isn’t just an energy play; it’s critical infrastructure for the entire tech revolution.

5. Beyond Crypto Hype: Building the Internet’s Financial Plumbing with Blockchain & Bitcoin

When the conversation turns to “crypto,” Wood quickly pivots, preferring to frame it as the development of an “internet financial system.” Think of it as building the missing financial layer that the first wave of the internet forgot. The core promise of blockchain technology, in her view, is its ability to slash the hidden “transaction taxes” — those 2.5% to 4% fees skimmed by intermediaries in traditional finance — boosting efficiency across the board.

Within this new financial architecture, Bitcoin plays a unique and multifaceted role. ARK doesn’t just see it as digital cash; they categorize it simultaneously as a novel global, decentralised, rules-based monetary system, a groundbreaking technology in its own right, and a distinct asset class with low correlation to traditional stocks and bonds. This multifaceted nature underpins ARK’s famously bullish outlook, with a long-term price target reaching towards $1.5 million. That lofty prediction isn’t pulled from thin air; it’s based on Bitcoin steadily capturing market share across several key areas: growing institutional investment as regulatory clarity emerges (ARK eyes a 6.5% allocation target), displacing traditional gold as a preferred store of value (“digital gold”), and serving as a crucial financial insurance policy for individuals in emerging markets grappling with unstable or corrupt regimes. Interestingly, Bitcoin demonstrates both “risk-on” behaviour, thriving alongside tech growth, and “risk-off” characteristics, acting as a safe haven during specific financial crises, like the European debt crisis or the recent US regional bank scares.

6. Hacking Our Biology: Precision Medicine Enters its Golden Age

The convergence theme echoes powerfully in healthcare, where AI is dramatically accelerating the field of multiomics — the intricate study of our DNA, RNA, proteins, and cellular functions. This data-driven approach is unlocking capabilities previously confined to science fiction. Imagine detecting complex cancers like pancreatic cancer at their earliest, most treatable stages simply through a blood test — that’s the reality molecular diagnostics are bringing closer. Furthermore, the revolutionary gene editing technology CRISPR, already demonstrating cures for inherited diseases like sickle cell anemia and beta-thalassemia, is poised for further breakthroughs as AI, gene sequencing, and CRISPR technology reinforce each other’s progress. Wood believes we are “very close” to precision medicinebecoming mainstream, potentially ushering in a new “golden age” for healthcare, focused on cures and prevention rather than just treatment.

7. ARK’s Playbook: High Conviction Investing in a Disruptive World

So how does ARK translate these sweeping technological visions into an actual investment strategy? Crucially, they operate outside the traditional fund management playbook. Forget hugging benchmarks like the S&P 500; ARK relies entirely on its own intensive research. This involves a blend of top-down analysis, using frameworks like Wright’s Law to model cost declines in technology, and bottom-up, deep-dive research into individual companies. Potential investments are rigorously vetted using a six-point scoring system that assesses management quality, execution ability, competitive moats, product leadership, valuation, and the risks to their core investment thesis.

This research-driven conviction leads to a distinct portfolio approach. While acknowledging their holdings trade at a premium compared to the broader market, ARK justifies this by forecasting significant revenue growth and margin expansion, targeting a minimum 15% compound annual return over a five-year horizon. Their behaviour during market swings is also telling: when markets turn volatile, ARK doesn’t de-risk by diversifying towards index-like safety. Instead, they concentrate their capital into their highest-conviction names, doubling down on the companies they believe will lead the future. Conversely, during bull markets, they may diversify slightly, incorporating promising IPOs or revisiting ideas previously trimmed. With less than 10% overlap with traditional indices, ARK positions its strategies not as a core holding for everyone, but as a potential 1–5% allocation — a dedicated hedge against the inevitable disruption facing legacy industries.

8. Gazing Further: AGI, Quantum Leaps, and an Economic Surge?

Looking even further out, Wood touches on the frontiers. Quantum computing, despite recent buzz (like Microsoft’s breakthroughs), is still viewed as perhaps 15–20 years away from significant commercial impact and isn’t yet a core portfolio focus. However, Artificial General Intelligence (AGI) — AI surpassing human intelligence — is seen as much closer. Aligning with figures like Elon Musk, Wood suggests AGI could emerge around 2027, not necessarily as a job destroyer, but as a powerful enhancer of human intelligence and productivity.

Ultimately, the convergence of these five major innovation platforms — AI, robotics, energy storage, blockchain, and multiomics — fuels a profoundly optimistic economic outlook from ARK. They project that the resulting productivity boom could more than double historical real GDP growth rates, potentially pushing growth from around 3% to over 6% annually within the next five years.

Investment Takeaways:

- Focus Areas: According to ARK, the biggest opportunities lie in AI, robotics, blockchain, nuclear energy innovation, and precision medicine.

- Accessing the Vision: Platforms like InvestEngine offer access to ARK ETFs (e.g., ARK Innovation — ARKK, AI & Robotics — ARKQ, Genomic Revolution — ARKG) allowing investors to potentially tap into these themes.

- Know the Risks: High-growth, disruptive innovation portfolios are inherently volatile. Wood herself suggests they aren’t a core holding for everyone, advising a smaller allocation (1–5%) to balance risk and capture upside potential.

- The Long Game: Despite current market jitters, ARK’s outlook is fundamentally optimistic, betting that innovation will overcome short-term hurdles and drive significant growth by the middle of the decade.

Cathie Wood’s vision is bold, perhaps even controversial. But by connecting the dots between these powerful converging technologies, ARK presents a compelling case for a future that might arrive faster than many expect.